It rarely pays to wait until interest rates come down to buy. The window of

affordability can close anytime. If rates are high at the time of purchase buy

anyway and refinance later.

3. Buying with Your Eyes Focused on the Rearview Mirror.

Many home buyers look at past rates of appreciation to determine what

neighborhoods to consider when purchasing. Since past appreciation is rarely

an indication of what will happen in the future, be open to looking at

neighborhoods you thought you’d never consider. Investigate “value signals”

(good value, strong sales, convenient location, community spirit, community

action, renovation and new construction, etc.)

Dr. Eldred says, “Look for those neighborhoods that will be “hot” tomorrow,

not necessarily those that were hot yesterday.”

4. Not Knowing Exactly How Much You Can Afford.

How much home you can afford depends on how stable your finances are,

what types of properties you’re considering, the financing options available

to you, how good your credit is and so forth. Be sure to consult with a loan

officer before you ever start house hunting to insure that you can buy the

home you want. If you’re ready to buy now, think about being pre-approved

for a loan.

Why? Because pre-approval helps you save money. Pre-approved buyers

have great purchasing power and your agent may be able to negotiate a

better deal for you with pre-approval in your hand. Sellers are also more

inclined to accept your offer because they’re dealing with a buyer with an

approved loan. By completing the pre-approval process before finding a

home, you'll already know how much you can afford and you’re approved for

a loan so there’s little of the usual anxiety involved, and you’ll save time.

Sellers areo more inclined to accept your offer because they’re dealing

with a buyer with an approved loan.

5. Centering Negotiations on Price.

Many buyers feel as though they need to get the lowest price when offering

on a home, however, there are other concessions a seller can make that are

more beneficial to you, the buyer . Your real estate agent can negotiate on

your behalf for a seller-paid buy-down or closing costs, credit for repairs, or

perhaps a washer and dryer, etc. All of these things can save you money

when buying a home. Be sure and discuss all your options with your agent

and ask him or her to help you evaluate what’s best for your specific

situation.

6. Comparing Homes by Purchase Price.

Be sure to compare not only home prices but also the monthly costs

associated with those homes that you are considering. Costs for utilities,

property taxes, homeowner’s association dues, homeowner’s insurance

premiums, maintenance, and other expenses can vary widely from property

to property. Estimate the average monthly cost of homeownership on every

home you look at.

7. Failing to Plan for Homeownership.

“In survey after survey,” writes Dr. Eldred, “renters claim they “can’t afford” to

buy because they lack sufficient money for a down payment. Often this

belief reveals a lack of education about low (or no) down payment home

finance possibilities. But just as often, it reveals a failure to plan”. A loan

officer can show you how to pay off your bills, repair your credit, how to save

for a down payment, etc. Make homeownership your number one priority.

Changing your beliefs about whether you can buy or not is the first step to

buying a home.

8. Changing your “Loan Status” Before Your Loan Closes.

Changing anything about your financial picture before your loan closes can

greatly impact your ability to qualify for financing. It is absolutely critical to

avoid changing jobs, switching banks, moving money around, paying off

bills, opening a new charge account, or making any major purchases

(furniture, car, appliances, etc.) since doing so can delay your closing or

prevent you from obtaining a loan altogether.

9. Failing to Estimate Repair and Renovation Cost.

It’s very important to make sure that your new home is inspected by

professionals so that you’re fully aware of any problems the property may

have. Your agent can advise you on termite and roof reports, structural

inspections, and home inspections which cover the major systems (electrical,

plumbing, etc.) so that you are not hit with big bills immediately after you

move in. Know what you’re getting into before you buy.

10. Failing to Compare Loan Programs and Costs.

Every borrower has different financial goals and needs. Making a mistake on

your home loan financing can cost you thousands of dollars. Your loan

officer can assist you with all the facts and offers a lender can offer you,

securing you the best deal and furthermore giving you the right one for your

needs.

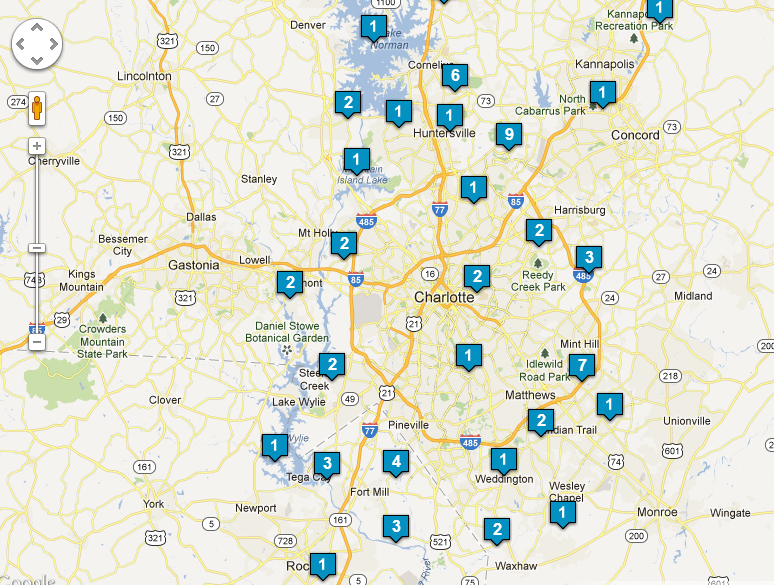

Homes For Sale Lake Norman

Up to $200,000

Call me for an appointment to view: Susan Dolan

If you need to find out how much you can purchase for, please call my friend

and Financial colleague David Woldman

This information was written and supplied by David Woldman

David Woldman, Charlotte Area Manager

NMLS # 659150 / NC State License #155537

7930 W. Kenton Circle, Suite 150, Huntersville, NC 28078